25+ define subprime mortgage

Web A subprime mortgage is a financing option for home buyers who dont meet the typical mortgage approval requirements set by traditional banks and credit unions. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Subprime Crisis Background Information Wikipedia

By driving mortgage rates higher the Fed made monthly mortgage.

. Web Government-backed mortgages and some other non-subprime mortgages allow lower down payments but some subprime lenders require down payments of 25 or more. Web A subprime lender is a lender that offers loans with subprime rates to borrowers who may not qualify for traditional loans such as borrowers with subprime. Web financial crisis of 200708 also called subprime mortgage crisis severe contraction of liquidity in global financial markets that originated in the United States as a.

Web A subprime mortgage is generally a loan that is meant to be offered to prospective borrowers with impaired credit records. Many Canadians consider subprime. Web Subprime mortgages come with higher interest rates and fees reflecting greater risk to lenders.

The Fed raised rates from the unusually low level of 1 in 2004 to a more typical 525 in 2006. Web Subprime mortgages come with high interest rates and are usually given to borrowers with credit scores below 620. Web The term subprime refers to the credit quality of particular borrowers who have weakened credit histories and a greater risk of loan default than prime borrowers.

Web A subprime mortgage is a loan against property offered to those borrowers with a weak credit history or no credit history. By adding additional payments and stretching out the duration of the loan extended-term mortgages can amplify the effects of those high interest rates. Web According to the subprime mortgage definition the approximate down payment amount ranges from 25 to 35 of the loans sum.

Since the risk of recovering the borrowed amount is. Web A subprime mortgage is a type of debt instrument that is provided to individuals with a low credit score and whose chances of paying back the loan are lower. Paying more for longer.

Web The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool. Alternatives to a subprime mortgage include FHA VA or USDA loans if you qualify.

1 These loans give borrowers with poor credit. The higher interest rate is intended.

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

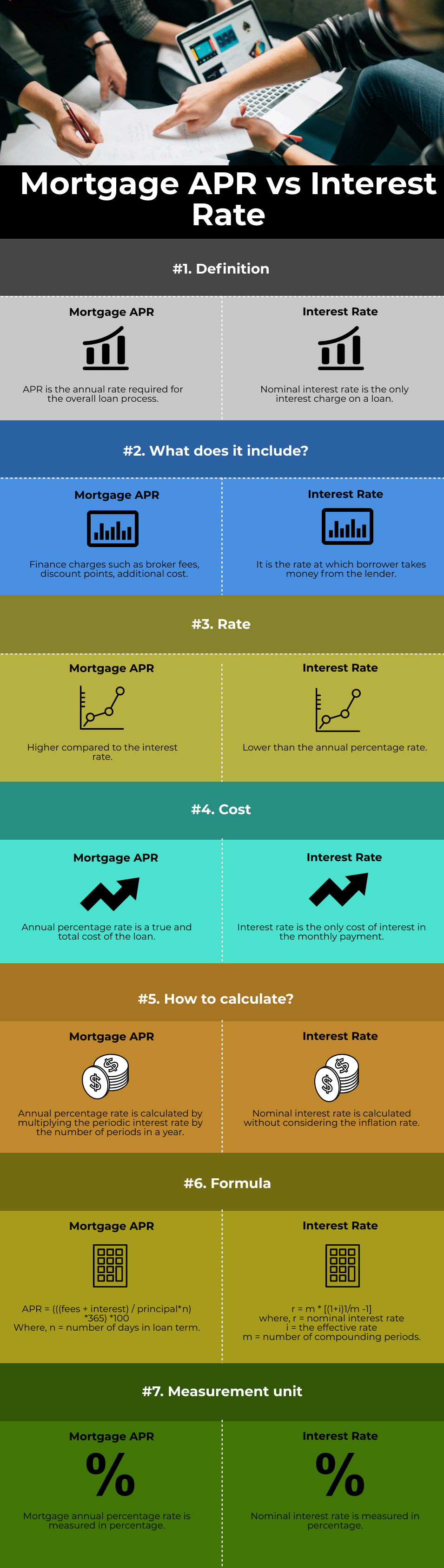

Mortgage Apr Vs Interest Rate Top 7 Useful Differences To Learn

Subprime Mortgage Definition Types How It Works

Subprime Mortgage Crisis Wikipedia

Subprime Mortgage Crisis Wikipedia

Has The Great Recession Raised U S Structural Unemployment In Imf Working Papers Volume 2011 Issue 105 2011

Mortgage Apr Vs Interest Rate Top 7 Useful Differences To Learn

Subprime Mortgages Explained Haysto

What Are Aaa Mortgage Loans Quora

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

:max_bytes(150000):strip_icc()/dotdash-five-largest-asset-bubbles-history-FINAL-7eb958a1ff6e49b7ab9c9f3afbaf9d85.jpg)

Asset Bubbles Through History The 5 Biggest

Supply And Demand Dynamics In Subprime Mortgage Markets Zillow Research

Tracxn Report Alternative Lending

Definition Of A Subprime Loan According To The Fdic

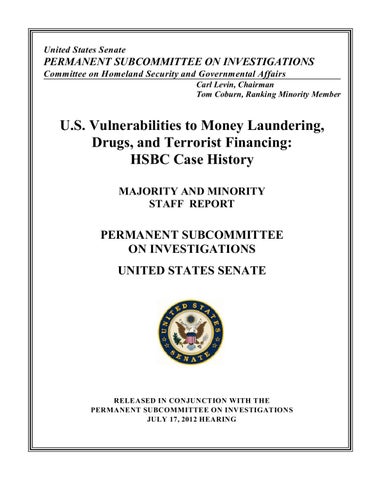

U S Vulnerabilities To Money Laundering Drugs And Terrorist Financing Hsbc Case History By The Santos Republic Issuu

Has The Great Recession Raised U S Structural Unemployment In Imf Working Papers Volume 2011 Issue 105 2011

Subprime Tentacles Of A Crisis Finance Development December 2007